We’ve got an exciting project underway that will be coming out soon!

The project is based on the “Is College a Rip Off?” series of blog posts.

The Student Loan Bubble? Classroom Fraud? The state of the job market?

We’ve covered it all….

Stay tuned!

We’ve got an exciting project underway that will be coming out soon!

The project is based on the “Is College a Rip Off?” series of blog posts.

The Student Loan Bubble? Classroom Fraud? The state of the job market?

We’ve covered it all….

Stay tuned!

I need a new computer!

My issue may not seem like an issue to most people, but I hope this helps you think of problems differently.

You see:

I need a new computer! My computer, despite still being relatively fast, is reaching the end of its life. I have had several component failures, the software is getting outdated, and components aren’t really compatible with the new technology. I could keep it limping along, but its really the lifeblood of a lot of my projects, and I can’t afford having downtime.

This seems like a pretty simple issue, right? Why don’t I just head down to my local best buy… head to newegg.com or amazon.com… or build something at dell.com or cyberpowerpc.com? Or maybe I should just build it myself and pickup the components on ebay.com, newegg.com, or tigerdirect.com?

I could settle for being cheap, and just buying the cheapest computer that will fit my needs… but I don’t like that idea either. I want a lightning fast m.2 NVMe SSD hard drive, and 64 GB ram. I want 6 GHZ with water cooling, and decent video cards. I want 3 large screen 4k monitors, and a sound card that can handle professional recording. I used to be cheap, but I don’t want to be cheap. There’s a place for bare-bones purchases, but this isn’t it. I don’t want to settle.

There is a huge problem with that logic, and that is: “How do I pay for it”?

Some people might ask if my credit card limit is high enough to buy the setup I want. The answer to that is “Yes”… but the problem is that I’m not going to use DEBT to buy a computer.

So others may say.. “Then go debt free and use your bank account… you have to have enough in your bank account, right”? My answer to that is: “Now if you checked my bank account, there’s enough to buy the computer I want”… but the problem is that I’m not going to use after tax, earned income to buy a computer!

And this is how thinking differs based on what level of the “Stabilize- Secure- Succeed!” process you find yourself.

Why do I need a computer? I need it for my business projects. If I use my bank account, I’m using AFTER tax, earned income. I don’t want to use After Tax earned income… that would be silly! Instead I need to use before tax revenue. It is after all, business equipment necessary to manage my businesses!

So I know i need to buy it from my businesses, not my wallet!

At this point you might be thinking, “OK fine- I get it, its a tax play. Now go use your business cash and buy it”

But again, its not that simple. You see, my businesses generate cashflow, which I use to buy more assets that generate cashflow. I don’t want to spend valuable cashflow on an expensive thing like a computer! Sure sure… you can argue it IS an asset that will generate more revenue than it costs, but it won’t really… it won’t generate more revenue than my CURRENT computer does, therefore it is a net loss.

So this raises a new challenge for me:

How can I generate enough money to buy the computer I want, without eating into my business cash flows, my personal debt, or my personal after tax cash?

These are fun challenges! There’s not only one answer, but a few of my ideas include:

So what will it be? I think in this case its the 3rd line.

So instead of spending my money to buy a new computer, I will be spending my money to buy assets that will pay for my new computer… and those assets will continue to spit off cashflow after the computer is done and paid for.

So next time you need a new computer, phone, or car… Don’t just think about how to get it cheap, think about using it as motivation to improve your future for life… and once I announce that I bought my new computer, you’ll also know that there will be new business to discuss!

and when I’m ready for a new car, we’re going to start this process over again…

Now go out there and make the impossible happen!

One of the must frustrating fallicies that I face with people all the time is the assumptions and statements around “Well everyone else does”.

The topic can very from, “Well my coworker at work drives a BMW, so I should be able to also” or “Everyone else has a car loan”. Even “Everyone has second mortgages”.

Do you know what the correct statement to these types of phrases is?

it is:

No. No they don’t.

Lots of people buy cars without car loans. Most people with your income don’t drive BMWs (and thats true no matter how high your income is!), and not everyone has a second mortgage to buy stuff they don’t need. Its time to put those stupid life-destroying statements to bed.

To help with that, I wanted to share a few examples that I think are pretty cool.

Geovanni Bernard-

I’ve personally been a huge fan of Gio his entire career. Evidently he drives a borrowed Honda Odyssey minivan. If that isn’t inspiration, I don’t know what is. Have you thought about how your wallet would do if you drove a borrowed car instead of paying for one?

Kirk Cousins-

Kirk Cousins is a Redskins Quarterback who brings in around 20 million dollars per year. What does he drive? He drives a GMC Savana with over 100k on it. He purchased it in 2014 for the paltry sum of $5,000. (Thats less than .03% of his salary…)

How about you try spending less than .03% of your salary on a car? Think that would put more in your retirement?

Alfred Morris-

Alfred Morris is another athlete we should all look up to. While he makes a couple of million dollars a year, he’s sporting a 27 year old Mazda 626! Thats right, from good ‘ol 2001. He was quoted by CNBC stating that this keeps him grounded, which it does.

I share this feeling. While I might not make the kind of money a pro athlete does, I make sure I always have at least 1 “beater car” to help keep me grounded!

Mitchell Trubisky-

Mitchell may not be the wealthiest of athletes, but he sports the most average car in the world- a 1997 Toyota Camry… in Beige. This was a gift from his grandmother, and show’s a certain aire of responsibility!

LeBron James-

If Football isn’t your thing, how about the quarter-of-a-billionaire LeBron James? I love his story. He received some criticism for endorsing Kia… but the part that most people seemed to miss is that he was driving a Kia well before an endorsement deal! And why not? Kias offer a great car with a great warranty at a great price! So why is this one last? well his Kia does happen to be a K900, and he happens to have a few high end exotics back home as well…

This isn’t a complete list either. James Harrison and Antonio Garay both sport $4,000 Smart cars. Jake Rudock rocks a 2003 Manual Transmission Ford Explorer. Nnamdi Asomugha enjoys a 1997 Nissan Maxima and John Urshel bought a Nissan Versa for $9,000 AFTER he was drafted by the Ravens with a $144,560 signing bonus. I’m also sure there’s a few others.

So whats the moral of the story here? If Millionaires and Billionaires (because there’s a few of them too- Jeff Bezos for example) thing a several thousand dollar car is good enough for them, then why isn’t a several thousand dollar car good enough for you? How many people do you know that insist you have to spend $30,000 for a “decent car” and insist that they deserve to drive a BMW?

They don’t. You don’t have to either!

Sources:

https://www.cnbc.com/2017/11/03/millionaire-athletes-who-drive-super-cheap-cars.html

https://gearheads.org/professional-athletes-that-drive-beater-cars

What type of privacy do you deserve in public?

For example, if you are sitting with a group of people in a restaurant, or at a sporting event, and you are talking loudly with your friends… do you get or deserve privacy?

This is an interesting question because I believe many of us are very guilty about listening in to other conversations. In fact often we actively try not to, but unfortunately some people can be SO LOUD you can not NOT listen to them.

While sometimes it can be obnoxious, I unfortunately learn a lot about people when I listen. In general I try not to judge an individual’s actions as much as I notice group’s thoughts. I also know people will at some times “agree” with group think, just to head home with an immense amount of opinionated judgment.

The thing about individuals is we are all different, and using one individual’s thoughts alone does not give you a good judgment of how groups of people think. There are individuals who have just about every possible thought imaginable.

But when you hear groups of people talking about similar things multiple times in multiple places, that gives you some real insight into how larger groups of people think and behave. Therefore my daughter’s sporting events, practices, doctors appointments, checkout lines, sporting events, and many other similar things become great places for opportunistic research.

While the statisticians among you will probably point out the fact that this type of “research” surely isn’t going to stand up to statistical sampling scrutiny, it does offer a great source of information, potential hypotheses, and case studies. They also serve to challenge any presented hypothesis that most people are “doing it right”.

I wish I could stop these conversations and say “Do you realize what you’re saying? Do you realize what this means for your family?”

I also wish I could say “I’m writing about you RIGHT NOW on my blog, you might want to check it out when you’re done”

And I’m not referring to the many conversations about less savory personal details questionable fashion decisions… I’m referring to the plethora of statements talking about “Cost” and “Buying” and “Affording”.

I’m amazed at how often these type of statements come up. In fact I don’t know if most people would have any idea how much they even discuss it. The fact of the matter is that while many people seem to suggest it’s not appropriate to “discuss” finance with friends (which is silly by the way- how else do you learn?), they subconsciously talk about it for hours upon hours a day to many many people. Every time they say “I can’t afford”, “I want to buy”, or “It Cost” you are talking about finance. Complaining that you can’t afford a $20 Leotard and less than 10 seconds later talk about how you got a great deal on a $130 Coach Purse? What is it?

If we are spending hours a day talking to our friends about money and finance… what’s smart to buy, what’s not, what great deals we got and what we have to overpay on, what coupons we found, and how we save, 2nd mortgages, store credits, credit cards, buying cars… all this information… all things that really speak to the negative drawbacks of consumerism, how do we claim talking about doing GOOD things with our money is not a safe topic for friends or public discussion?

The thought process here is ludicrous. We send messages to each other daily… sometimes by the minute. We reinforce to our friends and neighbors that debt is good. Consumerism is good. Spending money we don’t have is good. Buy buy buy. Borrow borrow borrow. Ruin your life. Destroy your kids. Yes this is good, acceptable conversation, but being smart, savvy, protecting our kids, our families, and our society isn’t appropriate?

Please.

We talk about buying because we can’t help ourselves. We see things we want, we lust for things we can’t have, and we can’t stop ourselves from buying. We look to our social interactions to make this OK, to make us feel better about the dumb things we are doing and the hole we are digging.

I was reading a thread on biggerpockets.com , a great resource if you are into real estate, and the question was discussed: “Do you tell your coworkers about your real estate?”. I was surprised how many people said “no”. I made the argument that you should. We have a duty and responsible to help each other, not continually tear each other down by reinforcing bad habits.

There’s not going to be a movement, but do your friends a favor. Talk about the cool smart things you do. Talk about how you save. Talk about how your preparing for the future and generating wealth. Then when they see you living the life they wish they had, it won’t be “luck”, it’ll be because of what you’ve been talking about all along.

It’s not about looking down on people and being judgmental. Don’t look down at people who don’t think like you, but don’t isolate yourself either. I can’t tell you how many people have told me they have shifted their behavior because of me. How many people have told you they started saving, started a business, bought real estate, saved in a 401K or IRA, or did other positive financial moves because of you?

And how many people do you know that bought a purse, bought shoes, tried a restaurant, or bought something else you recommended?

I’ll tell you right now, the most successful people I know have conversations with me regularly about finance, wealth, and money. Most of these people are “uncomfortable” having these conversations with the less successful. Which part of that is causal? How much of this is because many people don’t understand?

Be a positive influence on those around you. You owe it to yourself and to them.

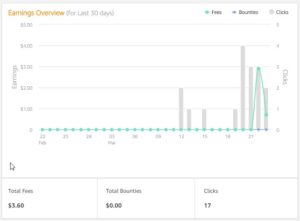

You may have noticed that as of this week, there are some Ads on Millionairewho.com

Hate it, don’t you?

At least I’m fully disclosing WHAT and WHY. It wouldn’t be fair for me to do otherwise.

There’s three types of ads you’ll see on here:

The first type is a Google Adwords ad. These are auto-generated by Google based on whatever you have stored as cookies on your computer. I have no control over what you see:

In my first week with Google ads, I’ve brought in an impressive one penny. Yes, thats no exaggeration- I’m proud to inform you I made a penny. Whoohoo! Thanks.

The second type of ad you’ll see is an Amazon Affiliate program ad. Again, these ones I have no control over what you see. It may automatically select something related to what I am discussing, or it may not This looks like this:

Amazon will offer a little bit more than Google, but only if you buy whatever it is that shows up. For example if it lists a $20 movie, I could make 40 cents. If you don’t buy the movie, I get 0 cents.

And the last type of ad you’ll see is a specific product link to amazon. Its true that I get paid a couple of CENTS if you buy through this link, but you pay the same price you would if you just went to Amazon directly, and lets be honest- you’ll probably buy it at Amazon anyway, so why not help me out with a few pennies (literally) when you buy?

Here’s my DAUGHTER’s book she wrote:

Here’s what I do promise.

I will never link to an amazon product explicitly for the purpose of getting you to buy something.

I’m a professor first, and will give honest recommendations. Any product that I recommend and link to is something I authentically recommend, and I am offering the amazon link as one way to buy it. For example, I already wrote a number of book reviews that are scheduled to show up in the blog over the next 3 months. I recommend some of the books. I tell you not to waste your time with others, but regardless of whether I recommend it or not, I will put an amazon affiliate link at the end of it. If you choose to buy it, great! its always a good thing to learn, and I’ll appreciate the pennies I receive from your purchase. If you choose not to buy, I hope your learning in other ways but I’m still here to serve you!

So here’s an example of what was sold so far this week:

(This is a screenshot of Amazon Associates)

See? full disclosure, and no games!

“So why are you trying to make money anyway?”

First off, websites cost money. This website costs several hundred dollars a year to host, plus the domain name. The podcast hosting service charges between 60 and 500 a year depending on how many podcasts go up. In addition, to record the video podcast I need a video camera, and due to feedback from listeners that the audio quality could be improved, I invested in new semi-professional microphones. Some day I could use a better camera… and better mounts.. and maybe some better software to edit these things.

At this point I’ve spent around $800 on this website, and thanks to ads I’ve earned almost $4 back. Whoohoo!

I don’t anticipate MillionaireWho will ever be a massive money maker. That isn’t the reason I started it- I started it because I’m a natural teacher. I want to help others and love to see others succeed. You can ask the hundreds of students who have taken my classes and I believe they will fully agree. I hope some day to generate enough money to hire someone to help maintain this website and edit the videos and audio so they are even better for you, but in the mean time I’m hoping to generate enough to keep it alive long term!

Some might say- “you seem successful already, does a few hundred bucks matter”? If you ask me that, you need to listen to my podcasts and read my blogs, because every dollar matters. I might have brought in $4 in ads, but those $4 matter.. and I urge you to keep reading and listening if you don’t yet understand why!

Hopefully this helps some of you trying to figure out the “advertising” thing.

For others I hope this helps you understand WHY there are ads on this website.

I appreciate your support, and most of all- I appreciate you learning, educating yourself, and securing your wallet, Stabilizing your future, and Succeeding in Entrepreneurship and Finance! This world will be better if more people learn to be better with with their finances!

Sometimes you have to do some fun projects regardless of whether you expect an ROI or not!

I sponsored J-Lynn & the Partyboy in the creation of the song and video below. Don’t think I’m getting paid to refer this or anything, its just cool to see the results of your investments. Check it out and give them some hits!

You’ll hear about this on the podcast in a couple of weeks!

“Hello World”

It sounds odd to me to start a post with “Hello World” in 2017. You see, MillionaireWho.com was technically founded back in 2007, more than ten years ago. Ironically, its initial purpose is completely aligned with its current purpose, but its path took an unexpected route.

MillionaireWho 2007

MillionaireWho was first designed in 2006 as a blog to chronicle the life of a poor ramen-noodle fueled college student as he “Proved” how someone can become a millionaire simply by focus and hard work. The website was formally purchased and launched in 2007.

Despite not yet graduating college, I was overly confident that my gifted self would- from pure determination- do what so many people thought was impossible- become a rich man. I was determined to become a Millionaire by the young age of 25. Not only was I going to do it, but I was going to chronicle all the great things I was doing to make it happen.

My life from that point would most likely be chronicled best by a googling, “rollercoaster”. You see, it didn’t quite work out the way I anticipated it would. Despite having over 100 exciting blog posts about how my life was moving into the direction of wealth, the road was incredibly bumpy.

I closed my successful student-run vinyl cutting, graphic design, printing, and screen printing shop to “proceed towards a real job”, and I went to the top ranked Entrepreneurship school in the nation for my MBA. I then preceded to invest my life savings into a patent that went nowhere. I entered and even won business plan competitions, but lacked the cash to actually get the businesses rolling. I was working all day and working all night to get good grades and also try to run my software development business, and somehow I squandered all of my profits into failing software projects. I manufactured custom car parts for jeeps and sold them around the world, but quickly closed that business down because I thought there were more profitable opportunities elsewhere. I was miserable at home, my savings somehow balanced between 0 and a negative number, my attempts at stock trading were hit and miss with big penny stock wins followed by bigger losses. Despite having an international software development company with a number of employees in hand, I thought I needed to “adult” and get a traditional job. I rode right out of college during the great recession. Jobs were scarce, and I used that as an excuse for my inability to succeed. I scored a Vice President Job in 2009 working for the 2002 Ernst & Young Entrepreneur of the year, Greg Blair, and fell into a traditional employment path. After just a few years, my incredible enthusiasm and confidence waned and began to give. MillionaireWho.com died to me. After 2009, only one measly attempt to refresh it happened once I realized my net worth was only about 999,500 dollars short of my goal on my 25th birthday.

For years after I’d get the go daddy renewal notice for my domain-MillionaireWho.com . Every year I decided I was going to cancel it, but some part inside of me refused to give up hope. And consciously I “forgot” to do so… and so it went.

Flash Forward just 10 years to 2017

Almost ironically to me, when I stopped “trying to be rich,” a close friend to me commented about how he really looked up to me for my success. Here I was, still a very young adult, living in a nice home, driving a Ferrari, a fully loaded F350 diesel lariat, a Porsche, and a Cadillac all at once, working for a great company, with a beautiful and loving wife, giving back to my community, owning multiple companies and real estate investments, and with a net worth that finally exceeded that magic 7 digit number. I really was living the dream that I had just 10 years prior… a dream I almost gave up.

What lessons did I learn? What do I know now that I didn’t know then? How can I help others achieve what I achieved?

By now I was an award winning college professor, with students paying thousands of dollars just to take my classes on entrepreneurship, marketing, and other subjects. Here I was, a successful business person winning “Associate of the Year” at one of the largest corporations in the city. Here I was, investing my time and money into other business startups driving additional income channels and earning me recognition from surrounding municipalities. By now I had published two books with sales from countries around the world. I had keynoted graduation speeches, and sat on multiple boards of directors and advisors. Colleagues twice my age were asking for my advice on savings and investments. Readers from around the world were buying my books on automotive strategy. People I barely knew were asking for me to help coach them on how to be financially free. I didn’t just feel the need to help others realize how to get here… I found myself with few others more qualified to do so.

This sudden realization became the re-birth of MillionaireWho.com – the education network.

I can assure you, I’ve “been where you stand” now, and more than ever I can look back at my life and know that if I can do it, you can too… So come let me accompany you on your journey, whether you are in a bad place trying to improve by Stabilizing your wallet, doing alright but trying to Secure your present and future, or doing great and looking for Success! In Excelling and growing by leveraging your wealth, you don’t have to follow the path alone like I did.

Welcome to MillionaireWho!